Why specialty reprocessing is on the rise (and what it means for hospitals)

January 27, 2020

By Lars Thording

To combat rising healthcare costs, the reprocessing of single-use devices has started to expand to more advanced technologies, thereby increasing the amount of savings that reprocessing can deliver on a per-procedure basis. This notable shift has significant implications for the competitive landscape of manufacturers and reprocessors as well as for hospitals. Let’s take a look at the trend toward more-advanced device reprocessing, the related rise in specialty reprocessing, and what hospital management needs to understand about the future of this space.

The history of single-use device reprocessing

Since around 2000, single-use device reprocessing has been targeting fairly simple, mostly commoditized devices that are labeled “single-use” by the manufacturer but reusable (due to strict FDA regulation and oversight) through third-party reprocessing companies. There have been less than a handful of reprocessing companies, and the largest ones covered all areas of reprocessable “single-use” devices: OR devices, electrophysiology (EP) devices, and commodity items used throughout the hospital, such as compression sleeves and pulse oximeters.

Around 2010, the two largest reprocessors (Ascent Healthcare Solutions and SterilMed) were acquired by large medical device companies. A few smaller reprocessors, mostly focused in the low-tech device area, survived and developed in their regional or device specialty markets. However, in the years that followed, several of these were acquired, and hospitals consequently had to run their reprocessing programs through either Stryker (Ascent Healthcare Solutions) or Johnson & Johnson (SterilMed).

Emerging trends in the industry

Over the past four or five years, the industry has begun to change in ways that could have profound impact on hospitals’ opportunity to reduce per-procedure costs through reprocessing. Consider the following:

The large medical distribution companies have joined the industry: Medline acquired MEDISSISS, a small reprocessing company, in January 2012; Cardinal acquired the reprocessing arm of another technology company and in 2015 formed its Sustainable Technologies division. With deep reach into purchasing groups and hospital buyers through their massive distribution presence in the U.S. healthcare market, both companies have rapidly grown to become major players in reprocessing.

The reprocessing industry has become more fragmented: In the past, a reprocessor obtained FDA clearances to reprocess a portfolio of devices, collected those used devices, reprocessed the devices at its plant, sold them back to the customer and sent the reprocessed devices to the facilities. As is often the case in adolescent industries, this concentration of all activities in one firm is being replaced by more specialized reprocessing activities.

More and more, reprocessing companies specialize in either distribution, regulatory and R&D, or sales. This means that the reprocessing industry has become an intricate web of business relations among reprocessors: For example, Medline (distributor) sells Innovative Health devices under private label; Northeast Scientific (sales) has leveraged Innovative Health as an R&D partner; Stryker (sales) gets some of its products from Medline, etc. This development is as logical as it is confusing. It’s tough to be the best at everything from R&D to sales and distribution, so companies concentrate and “outsource” other activities. What drives the integration among reprocessors is that most hospitals have traditionally wanted to work with only one reprocessor, meaning the sales/distribution firm would have to be able to offer the full portfolio of reprocessed devices.

A strategic split between volume reprocessors and niche reprocessors has emerged: During the last half of the 2000s, the major reprocessors all achieved FDA clearances for the devices that were technologically accessible (i.e., relatively easy to reprocess) in the EP lab, in the OR, and on the floor. Since the early 2010s, most reprocessors have not looked to more FDA clearances for growth in hospital savings. Rather, they have looked to add markets or increase same-store sales (getting more savings for the hospital through program management and education).

Unlike the volume reprocessors, niche reprocessors have focused on growing savings on only a few product lines. Niche reprocessors include Innovative Health (cardiology) and Northeast Scientific (intravascular).

The specialty reprocessor has emerged: From this strategic evolution, the specialty reprocessor has emerged. Today, a reprocessor can grow in one of two ways: either through volume (market growth or market expansion) or by getting more FDA clearances so that more devices can be reprocessed. The challenge for non-volume reprocessors has been that all the low-hanging fruit (in terms of easy-to-reprocess device types) has already been picked. This means that without the market reach of the volume reprocessors, a reprocessor must develop a deep and narrow clinical, regulatory and technological focus on specific devices. This enables them to obtain FDA clearances for devices that in the past have been seen as not reprocessable.

These emerging trends are not surprising. In fact, almost every new industry goes through consolidation, fragmentation, and specialization. In my view, these trends are positive for the industry, as well as for hospitals, as reprocessors play to their strengths and increase the savings value to hospitals through refined strategies.

Specialty reprocessing

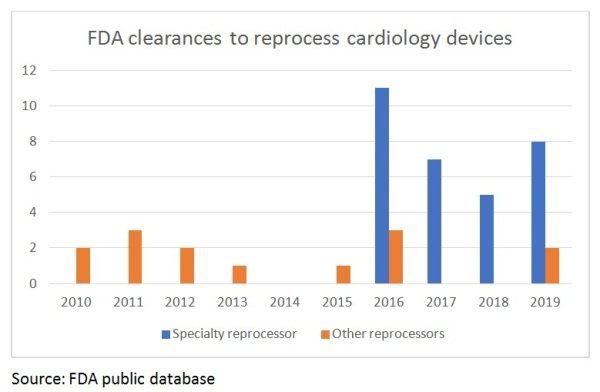

Since all the low-hanging fruit has been picked, new FDA clearances are increasingly demanding, both regulatorily and technologically. A company must invest substantial resources in R&D to be able to achieve these clearances.

Over the past five years, specialty reprocessing has largely driven FDA clearances for new devices, thanks to the development of “reprocessing technology,” a series of highly specialized methodologies, standards, validation techniques and testing practices. These include, for example: hemostasis detection capability; micro lumen occlusion detection, cleaning and inspection; hydrophilic coating performance characterization; electronic programable memory decryption, read and write capabilities; advanced visual inspection methodologies, 3D mapping location sensor performance characterization and testing; advanced, custom cleaning validation methodologies; and advanced non-destructive material identification methodologies.

Reprocessing an advanced electrophysiology mapping catheter with microlumens is a world apart from reprocessing a compression sleeve. This means that beyond optimizing existing reprocessing programs in terms of collection compliance, sound buy-back practices and clinician support, savings can only grow from working with specialty reprocessors or with distributors of specialty reprocessors.

Specialty reprocessors don’t just develop new R&D and regulatory competencies; they have to develop deep clinical skills through frequent interaction with clinicians who – rightfully – insist that they feel comfortable with the new devices – and to understand how the devices should feel and function. Different clinical areas of the hospital have different dynamics. Because of their very narrow focus, specialty reprocessors are also able to create reprocessing programs that are tailored to a specific clinical area. The EP lab is a different landscape than the OR in terms of purchasing decisions, utilization decisions (which device should be used) and others. Specialty reprocessors optimize reprocessing programs specifically for the dynamics of their clinical area.

What does the specialty reprocessor mean for the hospital?

There are several implications for hospitals to consider when responding to the emergence of the specialty reprocessor and the other trends that are now changing the industry:

• Assuming that the existing reprocessing program is running smoothly, the only way you can increase savings is by working with a specialty reprocessor that can secure more FDA clearances so more devices can be reprocessed. Ask the question to your reprocessing partner: How can you increase our savings? In the electrophysiology lab, some of the newest specialty reprocessing devices have increased savings by $1,000 per procedure – or doubled savings. Reprocessing a few more $50 catheters through program optimization does not reach this level.

• Yes, I know that it is more convenient to have one reprocessing contract than to have several. However, this efficiency in supply chain management may come with a high cost. If your current reprocessor does not have clinical area focus, it is likely not growing clearances and savings. Carving out a clinical-area-specific specialty reprocessing program that optimizes savings in a key area like electrophysiology may require two contracts, but this can significantly boost your savings.

• Whether working with a reprocessor that covers all clinical areas or one that is specialized, hospitals must demand specialized knowledge of clinical practices as well as technology. If all your reprocessing partner does is to walk into the hospital and pick up devices, you are likely missing out on major savings. A reprocessing program is only as effective as the confidence of the clinical staff and the level of interaction with third-party reprocessing staff.

• Ask your reprocessing partner for its R&D pipeline: What new clearances are being pursued with the FDA so that savings can increase? Here is the worry: It your reprocessing partner is not getting more clearances, you will not grow savings, and you are likely to see your savings go down. This is because of the short product life cycles in fast-growing procedural areas: A new technology comes out, replacing a device that could be reprocessed with one that can’t. Unless new clearances are achieved, the savings are now down.

• Expect specialized service programs across different hospital units. As mentioned, each area of the hospital functions in its own way in terms of clinical dynamics, purchasing, etc. Your reprocessor should design specific programs to optimize savings in each area.

In general, specialty reprocessing has a lot to offer the hospital in terms of substantially higher cost savings. Thanks to integration in the industry, there are many options to choose from, including working directly with specialty reprocessors or working with companies that collaborate with specialty reprocessors.

About the author: Lars Thording is VP of marketing & public affairs at Innovative Health LLC.

To combat rising healthcare costs, the reprocessing of single-use devices has started to expand to more advanced technologies, thereby increasing the amount of savings that reprocessing can deliver on a per-procedure basis. This notable shift has significant implications for the competitive landscape of manufacturers and reprocessors as well as for hospitals. Let’s take a look at the trend toward more-advanced device reprocessing, the related rise in specialty reprocessing, and what hospital management needs to understand about the future of this space.

The history of single-use device reprocessing

Since around 2000, single-use device reprocessing has been targeting fairly simple, mostly commoditized devices that are labeled “single-use” by the manufacturer but reusable (due to strict FDA regulation and oversight) through third-party reprocessing companies. There have been less than a handful of reprocessing companies, and the largest ones covered all areas of reprocessable “single-use” devices: OR devices, electrophysiology (EP) devices, and commodity items used throughout the hospital, such as compression sleeves and pulse oximeters.

Around 2010, the two largest reprocessors (Ascent Healthcare Solutions and SterilMed) were acquired by large medical device companies. A few smaller reprocessors, mostly focused in the low-tech device area, survived and developed in their regional or device specialty markets. However, in the years that followed, several of these were acquired, and hospitals consequently had to run their reprocessing programs through either Stryker (Ascent Healthcare Solutions) or Johnson & Johnson (SterilMed).

Emerging trends in the industry

Over the past four or five years, the industry has begun to change in ways that could have profound impact on hospitals’ opportunity to reduce per-procedure costs through reprocessing. Consider the following:

The large medical distribution companies have joined the industry: Medline acquired MEDISSISS, a small reprocessing company, in January 2012; Cardinal acquired the reprocessing arm of another technology company and in 2015 formed its Sustainable Technologies division. With deep reach into purchasing groups and hospital buyers through their massive distribution presence in the U.S. healthcare market, both companies have rapidly grown to become major players in reprocessing.

The reprocessing industry has become more fragmented: In the past, a reprocessor obtained FDA clearances to reprocess a portfolio of devices, collected those used devices, reprocessed the devices at its plant, sold them back to the customer and sent the reprocessed devices to the facilities. As is often the case in adolescent industries, this concentration of all activities in one firm is being replaced by more specialized reprocessing activities.

More and more, reprocessing companies specialize in either distribution, regulatory and R&D, or sales. This means that the reprocessing industry has become an intricate web of business relations among reprocessors: For example, Medline (distributor) sells Innovative Health devices under private label; Northeast Scientific (sales) has leveraged Innovative Health as an R&D partner; Stryker (sales) gets some of its products from Medline, etc. This development is as logical as it is confusing. It’s tough to be the best at everything from R&D to sales and distribution, so companies concentrate and “outsource” other activities. What drives the integration among reprocessors is that most hospitals have traditionally wanted to work with only one reprocessor, meaning the sales/distribution firm would have to be able to offer the full portfolio of reprocessed devices.

A strategic split between volume reprocessors and niche reprocessors has emerged: During the last half of the 2000s, the major reprocessors all achieved FDA clearances for the devices that were technologically accessible (i.e., relatively easy to reprocess) in the EP lab, in the OR, and on the floor. Since the early 2010s, most reprocessors have not looked to more FDA clearances for growth in hospital savings. Rather, they have looked to add markets or increase same-store sales (getting more savings for the hospital through program management and education).

Unlike the volume reprocessors, niche reprocessors have focused on growing savings on only a few product lines. Niche reprocessors include Innovative Health (cardiology) and Northeast Scientific (intravascular).

The specialty reprocessor has emerged: From this strategic evolution, the specialty reprocessor has emerged. Today, a reprocessor can grow in one of two ways: either through volume (market growth or market expansion) or by getting more FDA clearances so that more devices can be reprocessed. The challenge for non-volume reprocessors has been that all the low-hanging fruit (in terms of easy-to-reprocess device types) has already been picked. This means that without the market reach of the volume reprocessors, a reprocessor must develop a deep and narrow clinical, regulatory and technological focus on specific devices. This enables them to obtain FDA clearances for devices that in the past have been seen as not reprocessable.

These emerging trends are not surprising. In fact, almost every new industry goes through consolidation, fragmentation, and specialization. In my view, these trends are positive for the industry, as well as for hospitals, as reprocessors play to their strengths and increase the savings value to hospitals through refined strategies.

Specialty reprocessing

Since all the low-hanging fruit has been picked, new FDA clearances are increasingly demanding, both regulatorily and technologically. A company must invest substantial resources in R&D to be able to achieve these clearances.

Over the past five years, specialty reprocessing has largely driven FDA clearances for new devices, thanks to the development of “reprocessing technology,” a series of highly specialized methodologies, standards, validation techniques and testing practices. These include, for example: hemostasis detection capability; micro lumen occlusion detection, cleaning and inspection; hydrophilic coating performance characterization; electronic programable memory decryption, read and write capabilities; advanced visual inspection methodologies, 3D mapping location sensor performance characterization and testing; advanced, custom cleaning validation methodologies; and advanced non-destructive material identification methodologies.

Reprocessing an advanced electrophysiology mapping catheter with microlumens is a world apart from reprocessing a compression sleeve. This means that beyond optimizing existing reprocessing programs in terms of collection compliance, sound buy-back practices and clinician support, savings can only grow from working with specialty reprocessors or with distributors of specialty reprocessors.

Specialty reprocessors don’t just develop new R&D and regulatory competencies; they have to develop deep clinical skills through frequent interaction with clinicians who – rightfully – insist that they feel comfortable with the new devices – and to understand how the devices should feel and function. Different clinical areas of the hospital have different dynamics. Because of their very narrow focus, specialty reprocessors are also able to create reprocessing programs that are tailored to a specific clinical area. The EP lab is a different landscape than the OR in terms of purchasing decisions, utilization decisions (which device should be used) and others. Specialty reprocessors optimize reprocessing programs specifically for the dynamics of their clinical area.

What does the specialty reprocessor mean for the hospital?

There are several implications for hospitals to consider when responding to the emergence of the specialty reprocessor and the other trends that are now changing the industry:

• Assuming that the existing reprocessing program is running smoothly, the only way you can increase savings is by working with a specialty reprocessor that can secure more FDA clearances so more devices can be reprocessed. Ask the question to your reprocessing partner: How can you increase our savings? In the electrophysiology lab, some of the newest specialty reprocessing devices have increased savings by $1,000 per procedure – or doubled savings. Reprocessing a few more $50 catheters through program optimization does not reach this level.

• Yes, I know that it is more convenient to have one reprocessing contract than to have several. However, this efficiency in supply chain management may come with a high cost. If your current reprocessor does not have clinical area focus, it is likely not growing clearances and savings. Carving out a clinical-area-specific specialty reprocessing program that optimizes savings in a key area like electrophysiology may require two contracts, but this can significantly boost your savings.

• Whether working with a reprocessor that covers all clinical areas or one that is specialized, hospitals must demand specialized knowledge of clinical practices as well as technology. If all your reprocessing partner does is to walk into the hospital and pick up devices, you are likely missing out on major savings. A reprocessing program is only as effective as the confidence of the clinical staff and the level of interaction with third-party reprocessing staff.

• Ask your reprocessing partner for its R&D pipeline: What new clearances are being pursued with the FDA so that savings can increase? Here is the worry: It your reprocessing partner is not getting more clearances, you will not grow savings, and you are likely to see your savings go down. This is because of the short product life cycles in fast-growing procedural areas: A new technology comes out, replacing a device that could be reprocessed with one that can’t. Unless new clearances are achieved, the savings are now down.

• Expect specialized service programs across different hospital units. As mentioned, each area of the hospital functions in its own way in terms of clinical dynamics, purchasing, etc. Your reprocessor should design specific programs to optimize savings in each area.

In general, specialty reprocessing has a lot to offer the hospital in terms of substantially higher cost savings. Thanks to integration in the industry, there are many options to choose from, including working directly with specialty reprocessors or working with companies that collaborate with specialty reprocessors.

About the author: Lars Thording is VP of marketing & public affairs at Innovative Health LLC.