Almost 70 percent of providers

list improving consumer satisfaction

among their top priorities,

says a new survey

list improving consumer satisfaction

among their top priorities,

says a new survey

Consumer experience is top priority for 69 percent of US hospitals: survey

July 10, 2019

by John R. Fischer, Senior Reporter

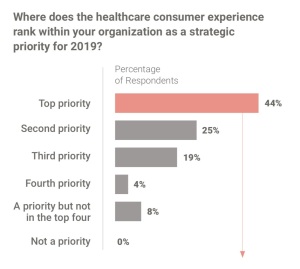

Improving consumer experience is top or second among the priorities of 69 percent of healthcare C-suite executives, according to a survey conducted by research firm Sage Growth Partners.

Commissioned by healthcare experience and patient navigation enterprise, Docent Health, the survey examines strategies implemented by hospitals across the country to improve such experiences, a task which is becoming essential due to changes in how healthcare services are managed and paid for, says Stephanie Kovalick, chief strategy officer for Sage Growth Partners.

“Consumers are starting to feel a higher burden of paying for services themselves,” she told HCB News. “Healthcare consumers have anywhere from $2500-$10,000, and sometimes even more in deductibles, so they’re paying for so much care out-of-pocket. As you start to spend your own money, you’re much more careful about the choices you make in how to spend that money. We’re seeing healthcare consumers a lot more discerning in where they’re going to receive care and how they make decisions for follow-up care based on the experience they had the first time.”

The surveyors spoke to 100 healthcare C-suite executives from different hospitals across the country in the first quarter of 2019, with 64 percent from highly competitive markets, 33 percent in moderate ones, and three percent in noncompetitive environments. Of the respondents, those in highly competitive markets were more likely to view improving consumer experiences as a top priority, at a rate of 55 percent. Only two percent of these providers did not consider it among their top four priorities.

To facilitate this improvement, 93 percent of respondents rely on telephone calls, 90 percent rely on EHRs, and 83 percent on patient portals. Only 35 percent use a centralized customer relationship management platform, and only 39 percent rely on text messaging.

More than half, however, use patient navigation programs, with 67 percent experiencing improved quality outcomes and improved patient engagement, while 65 percent report a higher number of patients sticking to care plans, and 54 percent seeing improved patient retention. Those that do use these programs outnumber those that listed improving consumer experience as a top priority.

Utilized the most in oncology, orthopedics and cardiology, the adoption of patient navigation programs is mainly stimulated by a desire to improve patient engagement, followed by greater patient adherence to care plans, reductions in unnecessary utilization/readmissions, and improved patient retention. While 81 percent of C-suite executives use navigators with clinical backgrounds, programs of high value rely on non-clinical navigators, which were found to be more effective than clinical ones. Ninety-one percent, for instance, experienced improved patient engagement, compared to 61 percent in the other category. The same pattern was found in assessments of patient retention and acquisition.

An additional 60 percent who said their programs were scalable across the enterprise experienced higher patient adherence to care plans and improved patient engagement, compared to 40 percent who said their programs were not scalable. Those who used a patient navigation program in conjunction with a CRM had greater positive outcomes, including improved patient retention and reduced unnecessary utilization/ED visits.

Kovalick says the importance of these navigation systems stems from the low healthcare literacy and healthcare IQ among consumers, which affects the ability to improve their experiences as patients.

“Many consumers don’t understand what a deductible is. They don’t understand how to go about getting a referral, or making appointments for a referral. They don’t know how to navigate the insurance system or healthcare system in general,” she said. “They justify by default and are unsatisfied with their experience because they don’t know how to do it themselves. That healthcare literacy makes it tough for hospitals and healthcare systems, even physicians, to improve the consumer experience without additional help. These non-clinical navigators enable patients to understand the process a whole lot better and therefore, have a higher level of satisfaction.”

While 43 percent of respondents do not yet have a patient engagement program, 33 percent plan to implement one in the next year or two. In addition, 70 percent of respondents have hired additional staff and implemented physician training to improve interactions with patients, while 32 percent have a dedicated C-suite executive such as a chief experience officer, whose one job is to improve the healthcare consumer experience.

Commissioned by healthcare experience and patient navigation enterprise, Docent Health, the survey examines strategies implemented by hospitals across the country to improve such experiences, a task which is becoming essential due to changes in how healthcare services are managed and paid for, says Stephanie Kovalick, chief strategy officer for Sage Growth Partners.

“Consumers are starting to feel a higher burden of paying for services themselves,” she told HCB News. “Healthcare consumers have anywhere from $2500-$10,000, and sometimes even more in deductibles, so they’re paying for so much care out-of-pocket. As you start to spend your own money, you’re much more careful about the choices you make in how to spend that money. We’re seeing healthcare consumers a lot more discerning in where they’re going to receive care and how they make decisions for follow-up care based on the experience they had the first time.”

The surveyors spoke to 100 healthcare C-suite executives from different hospitals across the country in the first quarter of 2019, with 64 percent from highly competitive markets, 33 percent in moderate ones, and three percent in noncompetitive environments. Of the respondents, those in highly competitive markets were more likely to view improving consumer experiences as a top priority, at a rate of 55 percent. Only two percent of these providers did not consider it among their top four priorities.

Improving patient satisfaction is

a top priority, mainly among hospitals

in highly-competitive markets.

a top priority, mainly among hospitals

in highly-competitive markets.

To facilitate this improvement, 93 percent of respondents rely on telephone calls, 90 percent rely on EHRs, and 83 percent on patient portals. Only 35 percent use a centralized customer relationship management platform, and only 39 percent rely on text messaging.

More than half, however, use patient navigation programs, with 67 percent experiencing improved quality outcomes and improved patient engagement, while 65 percent report a higher number of patients sticking to care plans, and 54 percent seeing improved patient retention. Those that do use these programs outnumber those that listed improving consumer experience as a top priority.

Utilized the most in oncology, orthopedics and cardiology, the adoption of patient navigation programs is mainly stimulated by a desire to improve patient engagement, followed by greater patient adherence to care plans, reductions in unnecessary utilization/readmissions, and improved patient retention. While 81 percent of C-suite executives use navigators with clinical backgrounds, programs of high value rely on non-clinical navigators, which were found to be more effective than clinical ones. Ninety-one percent, for instance, experienced improved patient engagement, compared to 61 percent in the other category. The same pattern was found in assessments of patient retention and acquisition.

An additional 60 percent who said their programs were scalable across the enterprise experienced higher patient adherence to care plans and improved patient engagement, compared to 40 percent who said their programs were not scalable. Those who used a patient navigation program in conjunction with a CRM had greater positive outcomes, including improved patient retention and reduced unnecessary utilization/ED visits.

Kovalick says the importance of these navigation systems stems from the low healthcare literacy and healthcare IQ among consumers, which affects the ability to improve their experiences as patients.

“Many consumers don’t understand what a deductible is. They don’t understand how to go about getting a referral, or making appointments for a referral. They don’t know how to navigate the insurance system or healthcare system in general,” she said. “They justify by default and are unsatisfied with their experience because they don’t know how to do it themselves. That healthcare literacy makes it tough for hospitals and healthcare systems, even physicians, to improve the consumer experience without additional help. These non-clinical navigators enable patients to understand the process a whole lot better and therefore, have a higher level of satisfaction.”

While 43 percent of respondents do not yet have a patient engagement program, 33 percent plan to implement one in the next year or two. In addition, 70 percent of respondents have hired additional staff and implemented physician training to improve interactions with patients, while 32 percent have a dedicated C-suite executive such as a chief experience officer, whose one job is to improve the healthcare consumer experience.